Next stop “Property Tax”: New online tax service to support private property owners in the reform process

With Steuerlotse für Rente und Pension (tax guide for pensions) we developed an online tax service last year on behalf of the Federal Ministry of Finance (BMF) specifically designed for people in retirement to help them file their income tax returns without a hitch. Now the next application is being created for the Ministry of Finance: in the context of the property tax reform, we are creating a simplified digital tax service to determine the amount of property tax – the “Grundsteuererklärung für Privateigentum (Property Tax Return for Private Property)”. A project with immense consequences for millions of private land and real property owners in Germany.

The property tax reform is one of the biggest tax reforms of recent decades. The reform goes back to a ruling handed down by the German Federal Constitutional Court (Bundesverfassungsgericht – BVerfG) in 2018, at which time the previous legal situation of valuing real estate at a standard value was declared unconstitutional and lawmakers were forced to revise the basis for the calculation.

A total of around 36 million properties are affected by the reform, many of them privately owned. For each of these properties, a return on the determination of the property tax value – colloquially known as a property tax declaration – has to be submitted digitally by owners via ELSTER in the period from 1 July to 31 October 2022. The declaration may only be submitted in paper form in exceptional cases.

The efforts associated with the reform are enormous. This goes on the one hand for the tax offices, which will be faced with a one-off additional burden in an avalanche of millions of declarations within a few months. And it is also the case on the other hand for the owners themselves, who have to provide the necessary information.

Accordingly, the Ministry of Finance's efforts to facilitate implementation of the property tax reform, wherever possible with a simple digital solution, and to reduce the associated obstacles are only logical.

The approach: reduce complexity

We have noted a very key take-away and lesson learnt from the Steuerlotse project: even in complex German tax law, there are a lot of simple issues that can be ideally mapped using customized digital solutions with a simple range of functions.

This also applies to property tax returns. A large number of stakeholders are private individuals who own detached or semi-detached houses, condominiums or even undeveloped plots of land – i.e. rather simple matters.

For this group, the property tax return can be shortened to a few details. This saves time and reduces possible errors.

The development: user-oriented, secure, open

An interdisciplinary team consisting of nine employees at present from the areas of product management, design and software development are working on the project. In addition, the Federal Ministry of Finance is a reliable project partner which is working closely with us and providing us with technical support. The project was launched in January 2022, and an initial minimal version of the software is to be online within six months.

True to our product philosophy, the online service for property tax is being developed in a user-oriented way. This means that we involve potential users in the development process from the very beginning.

In the run-up to the project, we have already held discussions with the target group to identify potential problems when submitting a property tax return. Recently, usability tests have been started, with the help of which we are collecting direct feedback on various prototypes.

Basic considerations for user guidance

Based on the experience from the Steuerlotse project and initial user discussions, we have derived the following product features:

Thanks to a dynamic questionnaire structure, the individual steps in the online form need to have a comprehensible logic for users.

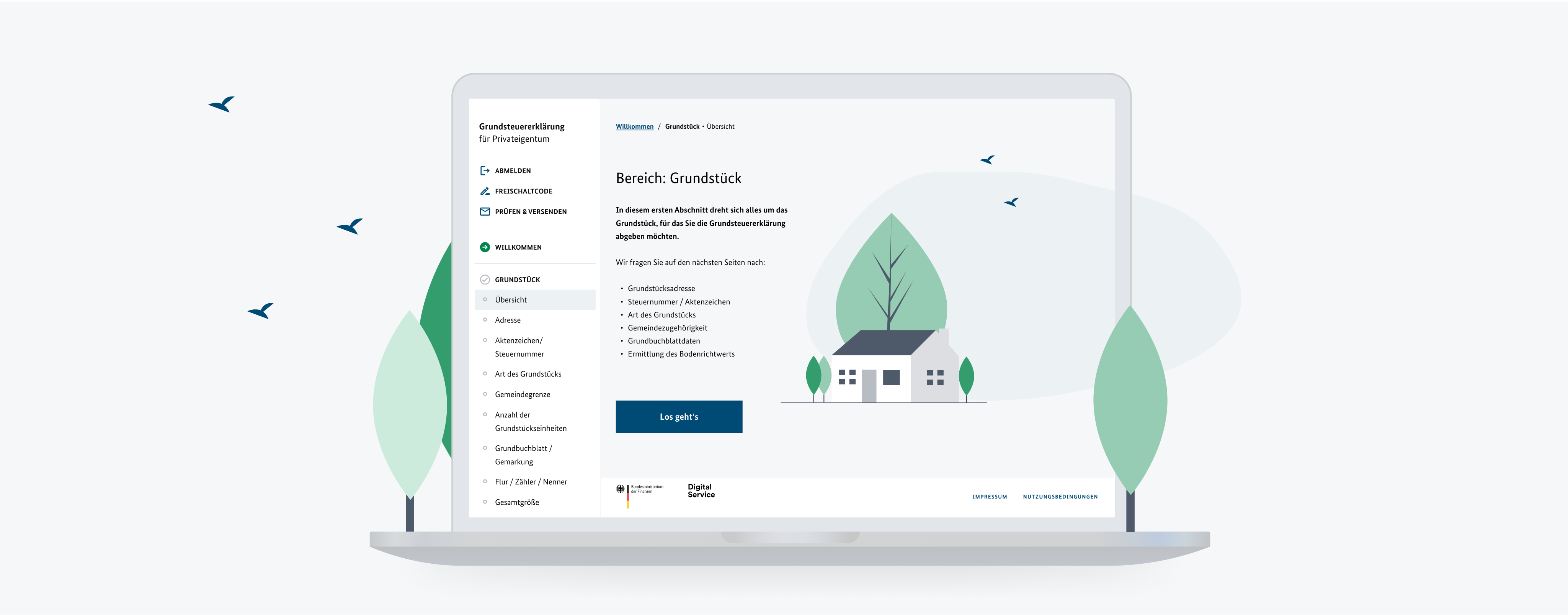

With the help of a revised page navigation and the “one-thing-per-page” approach (= one question/one context per page), the overview within the online form should be improved and a feeling of being overwhelmed by too much information avoided.

Simple language and visual aids are intended to lower barriers to use and make the declarations more accessible.

Overall, we want to empower the target group to complete the declaration on their own, without having to use paid services.

Principle of data security and data economy

In addition to user-centeredness, another focus is on the topics of data security and data economy. Our online service will only request data that is actually needed and will only store it if it is legally required. The data will be securely transmitted directly to the tax authorities via the official ELSTER interface and not processed for any other purposes.

The development is taking place as open source software, which will later be made openly accessible and reusable in accordance with the notion of “public money, public code”.

The online service “Grundsteuererklärung für Privateigentum (Property Tax Return for Private Property)” is to be available in time for the start of the submission period beginning 1 July 2022. It can initially be used by all private owners of real property in all those federal Länder that apply the so-called federal model.

Anyone who wants to find out more in advance can do so as of today at grundsteuererklaerung-fuer-privateigentum.de.