Pension Tax Guide

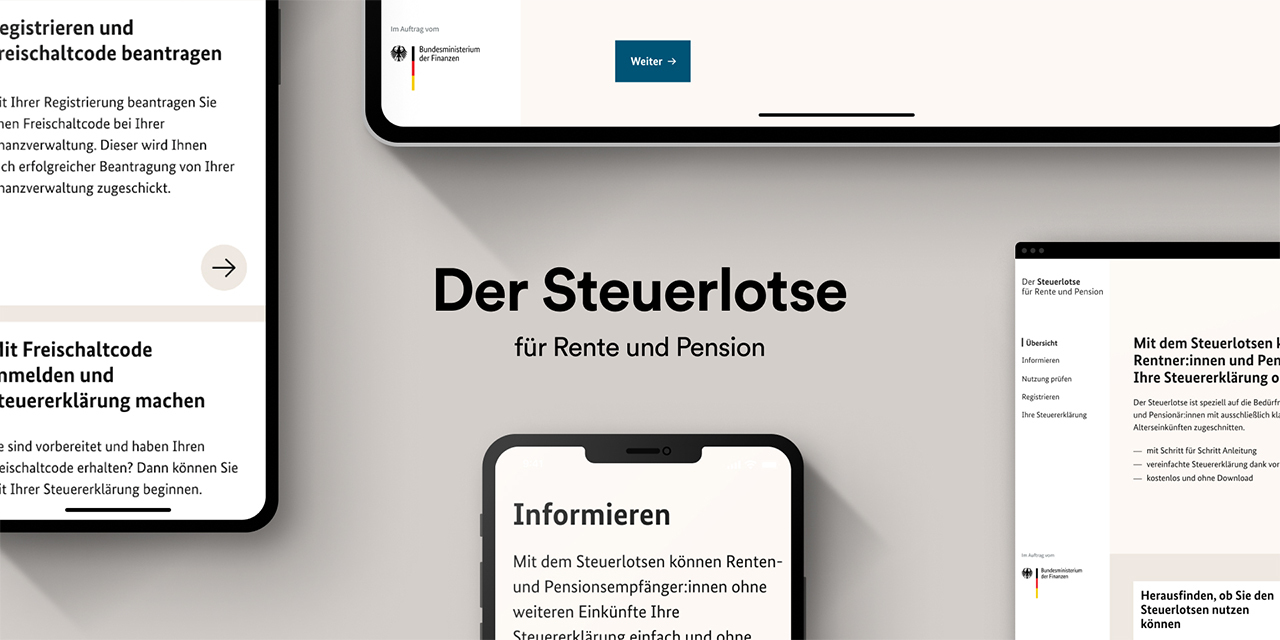

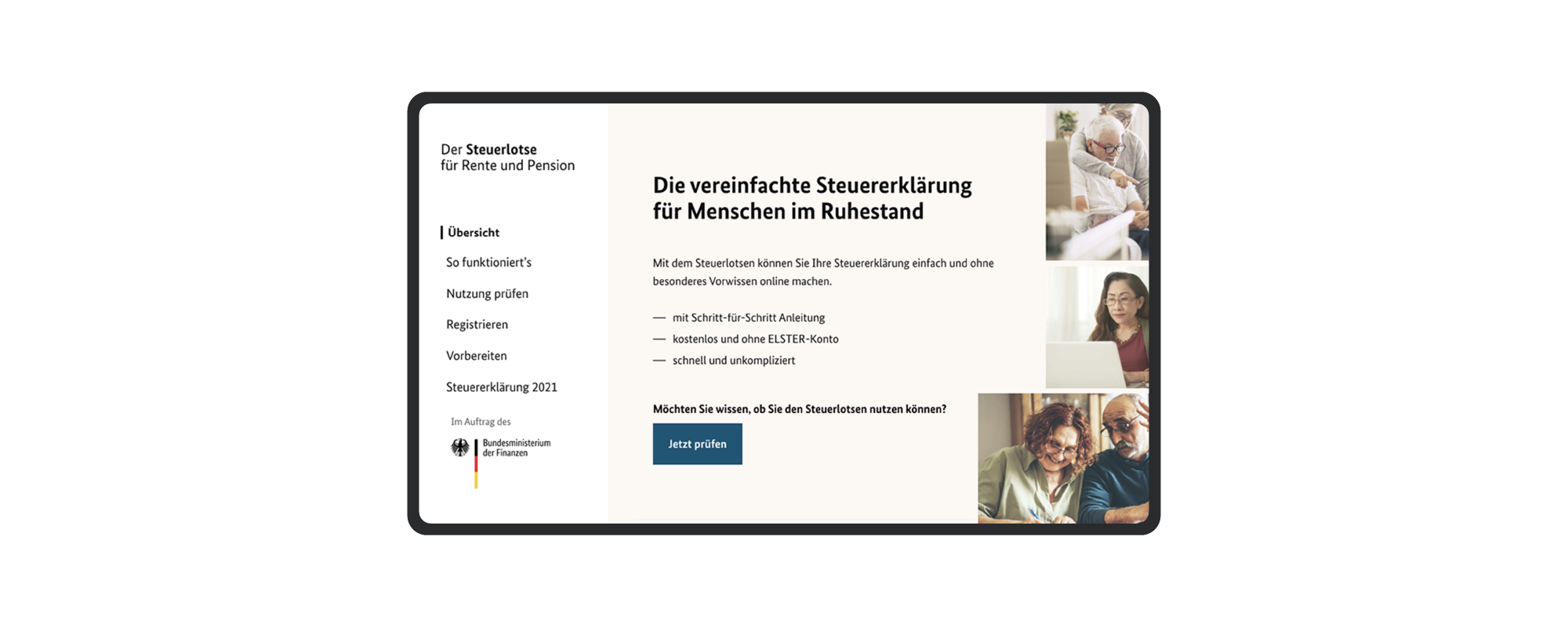

Simplified digital tax returns for older people

Millions of seniors in Germany have taxable income, so they are required to file tax returns. And for many of them, that’s a considerable challenge. Not only can the complexity of taxes themselves be overwhelming, but the digital filing process can be more of a hindrance than a help.

The majority of Germany’s nearly seven million retirees who are required to file taxes have a hard time doing so. The specialized terminology is hard to understand, and filing tax returns digitally is an obstacle for many as well, as they are not always familiar with digital technologies. On top of that, only four states had previously adopted the simplified return for taxation of retirement income, the EZVA, which existed in paper form. Together with the Federal Ministry of Finance, we developed an online tool to make the EZVA available digitally nationwide, allowing retirees to file their tax returns in minutes, intuitively and without needing any special pre-existing skills.

The tax guide was first launched for the 2020 tax season and was then updated on an ongoing basis until it was discontinued, in December 2022.

Special features

- One of the first projects at the federal level to be developed on a user-centric, agile basis

- Specifics pre-reviewed via questionnaire

- Simple, intuitive user guidance

- Simple language, no specialized knowledge or pre-existing skills required

- Data transmitted via ELSTER interface

Facts and figures

More than 5,000 tax returns were filed using the tax guide feature

Users took an average of 38 minutes to file their tax returns

Over 80 software enhancements provided during live operation

User

I’m over 80, and I always dread my tax return. Luckily, I found the tax guide. I’m really grateful for it.