Property Tax Return for Private Property

User-centered online service replaces confusing tax forms

The new German property tax reform created a lot of additional work for both owners and revenue offices. Millions of real estate owners were required to complete and file an additional tax return within a period of just seven months.

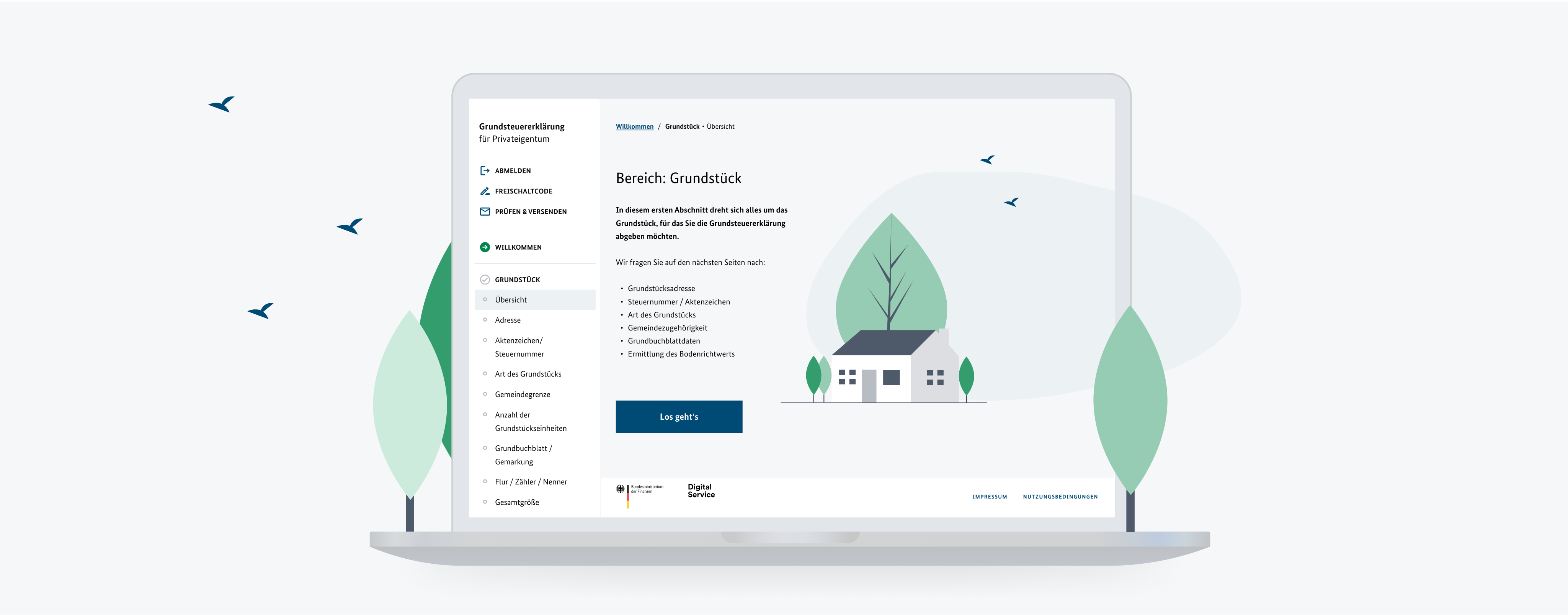

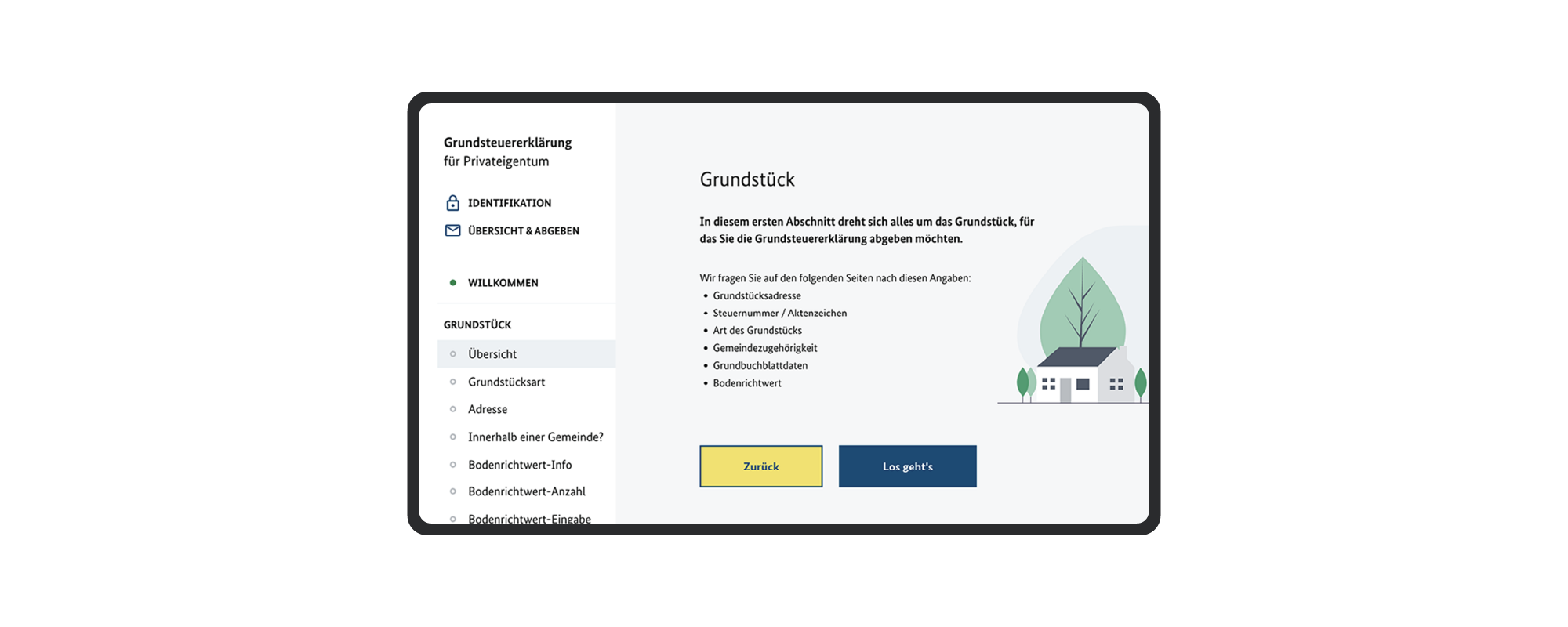

In 2018, the German Federal Constitutional Court held that the rules used for calculating property tax were unconstitutional. Some 36 million properties in Germany were subject to the ensuing property tax reform, many of them privately owned. Owners were required to file a digital property tax return for each of these properties between July 1, 2022, and January 31, 2023. We worked with the German Federal Ministry of Finance to develop an online service that guided owners through the property tax return process, simply and understandably. Key aspects of our approach and development included:

- User-centeredness: The service was developed with participation from the target group right from the start. Usability tests were conducted to identify owners’ needs and the challenges they faced and factor these into the design.

- Complexity reduction: The service made filing easier by slimming returns down to key information and using simplified language. This helped save time and prevent errors.

- Data security and data economy: The service collected only the information absolutely necessary and transmitted the data securely to the revenue administration to safeguard users’ data and privacy.

- Co-creation: We partnered closely with experts from the German Federal Ministry of Finance. Because we were participating in usability tests, it was possible to work directly with the product team to identify solutions for the difficulties users were seen to encounter.

The “property tax return for private property” service was activated on July 4, 2022, and was available to users until August 31, 2023. The free online option was available to users in the eleven states that use what is known as the “federal model” for property tax.

Special features

- Clear and intuitive user guidance and user interface

- Simple language used

- Magic links for registration and login

- Various identification options (activation code, ELSTER certificate, online ID function)

- Data transmitted via ELSTER interface

Facts and figures

Seven months until the go-live date for the minimum viable product (MVP)

Nearly one million property tax returns filed

Average time to complete and file a return: 15 to 30 minutes

User

In all honesty, it was really very well structured, very understandable, user-friendly, a reasonable amount of time and effort needed.

A real bright spot!

Read more about this project